Innovative Replenishing Structures Drive India’s Secur- itisation Market Growth

India’s securitisation market grew 33% on-year in fiscal 2023, with issuances totalling Rs 1.8 Lakh crore, marking a whopping 50% growth over fiscal 2022.

The originator base expanded by 20%, and newer asset classes such as personal loans, and small and medium enterprises loans gained momentum.

More heartening has been the emergence of new securitisation structures, including replenishing structures, which have grabbed the attention of many market participants.

In its Master Directions on Securitisation of Standard Assets issued in September 2021, the Reserve Bank of India had provided explicit recognition for replenishing structures, which has helped them gain foothold. Last fiscal, ~Rs 5,000 crore of pass-through certificates (PTCs) with replenishing structures were rated.

The deals were backed by pools comprising assets related to supply-chain financing, and vehicle, unsecured and consumer loans. Replenishing structures offer multiple benefits.

They enable long-dated PTCs to be issued backed by shorter-tenure loans, reduce re-investment risks for investors, and lower pre-payment risks. They are a variant of securitisation that involves sale of a pool of retail loans by an originator to a special purpose vehicle (SPV) trust, which then issues PTCs.

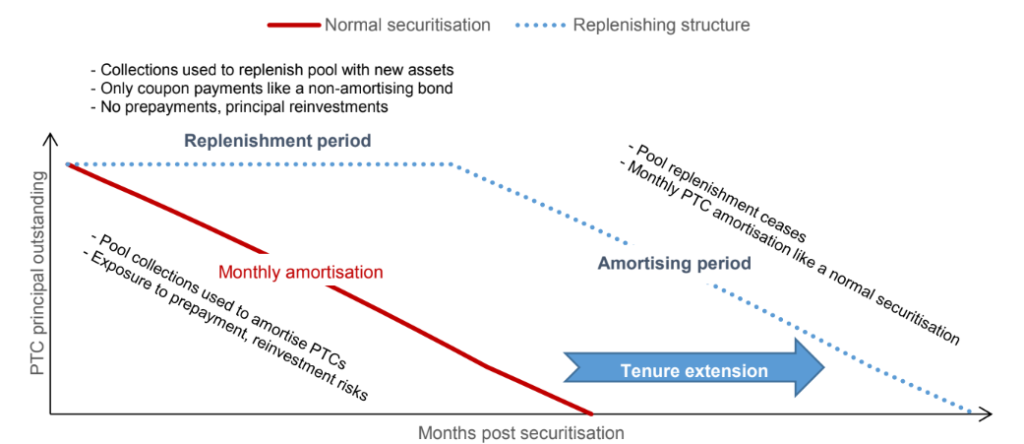

In a typical securitisation transaction, PTCs amortise monthly in line with the pool repayment schedule. In a replenishing structure, cash flows from the underlying pool are used to purchase new assets and maintain a collateral cover during a pre-defined period instead of amortising the securitised instrument.

Only interest payouts are made to investors during this initial ‘replenishment’ period. The PTCs get amortised subsequently, mirroring the repayment schedule of a pool in a typical securitisation transaction (see annexure).

Hence, unlike a normal securitisation transaction where the tenure of PTCs is typically coterminous with underlying loans, replenishing structures enable issuance of PTCs with tenures longer than underlying loans.

Replenishment periods can be customised to align PTC tenures with the requirement of investors.

Additionally, given the monthly principal payouts along with prepayments in a typical securitisation transaction, investors are required to frequently reinvest those proceeds, and that could also shorten the average life of PTC.

Replenishing structures provide protection against prepayments and reinvestment risks during the replenishing period, when the underlying pool’s cash flows are used to recycle the collateral pool and not to amortise the PTCs.

“Replenishing structures can attract investors such as mutual funds, and pension and insurance funds looking for stable cash flows over the medium to long term.

https://canarabank.com/, being dominant investors in the securitisation market, stand to benefit, too. They can conform to priority sector lending (PSL) requirements over a longer period by investing in PTCs backed by replenishing pools of PSL-compliant loans.

These structures provide opportunities for investors to lock into the typically high risk-adjusted returns offered by securitisation transactions over longer tenures, while also limiting prepayment and reinvestment risks,” a senior industry analyst said.

Wider acceptance of these structures by investors will also help originators of securitisation transactions.

“Financiers with stable disbursement pipelines can offer larger securitisation issuances through replenishing structures, backed by their ability to generate new loans that can be added to the replenishing pool, instead of floating multiple vanilla issuances at different points in time.

This can improve liquidity management and bring efficiency of scale for the originator by reducing the transaction cost associated with securitisation,” the analyst added.

With the securitisation market likely to maintain its growth trajectory,

replenishing structures are expected to gain momentum given their unique value proposition for investors and originators – investors with long investment horizons can benefit from longer tenures and lower prepayment and rein-vestment risks, while originators benefit from better asset liability maturity management and cost efficiencies.

Such structures would, however, entail additional risk aspects. Fortunately, there are structural features that can help address these risks. For instance, the underlying pool quality could vary during the replenishment period after the addition of new loans to replace existing loan amortizations.

New loans added to the replenishing pool must, therefore, adhere to well-defined eligibility criteria to ensure consistent pool quality. Such criteria are centred around factors that determine pool perfor- mance such as seasoning profile, credit scores, ticket sizes, interest rates, repayment track record and loan-to- value ratios for secured loans.

Moreover, unlike a typical securitisation transaction where credit enhancement levels build up as a percentage of the outstanding pool as the instrument amortises, credit enhancements remain static during the replenishing period.

Any undue risk accumulation in the pool during the replenishment period could reduce the loss-absorption cushion provided by the credit enhancement. To prevent build-up of risk during the replenishment period, early amortisation triggers are in- corporated into the transaction.

Such triggers are typically linked to the ability to add new loans, delinquency levels in the pool, credit rating levels of the servicer and the instrument, and the utilisation of credit enhancement. In case of a breach in these triggers, the instrument is typically amortised at an accelerated pace through ‘turbo-amortisation’.