“Middle East Oil Players Contemplate Price Reduction for Indian Market”

In an interesting push back to the Middle East oil players, India’s sharp spike in importing oil from Russia, is making many rethink the pricing structure. Sooner or later, Middle Eastern refiners may need to revise their official selling price to compete with Russia, feel industry analysts.

Over the past few decades, major geopolitical events usually led to sharp fluctuations in oil prices – the US invasion of Iraq (which triggered a 49% jump in oil prices from March 2003 to March 2004), the Afghanistan crisis (58% up from September 2001 to September 2002), and sanctions on Iran (43% up from September 2010 to September 2011).

Each of these events disrupted the crude oil supply chain. The usual pattern was this: developed nations would impose sanctions on an oil producer, and developing economies would struggle with high oil prices, and rising fiscal deficits.

The ongoing Russia-Ukraine conflict is the latest example, where many analysts expected $100 oil after the US and Europe stopped energy purchases from Russia.

But instead of the usual blanket ban, this time the G7 countries took a softer stand by capping the Russian oil price at US$60 per barrel. The sanctions are meant to ensure lower revenues for Russia, without hampering the oil supply chain.

India’s deep thirst for cheap Russian oil

The price cap on Russian oil has caused its Ural crude to trade at 40% below the international benchmark, Brent crude. In the first quarter of 2023, Russian Ural oil averaged USD 51.05 per barrel, while Brent crude oil was priced around USD 81.91.

India’s economy is highly susceptible to oil price fluctuations. A report by Edelweiss suggests that a 10 dollar increase in oil prices causes a current account deficit of 0.5% of India’s GDP. If India were to replace its entire import crude basket with Russian Ural, its current account deficit could contract by 1.6%-1.7% of GDP.

The landing cost (including freight and insurance) of Russian Ural for India was roughly USD 70 in March. India and China are snapping up cheap Russian crude in large quantities – Russia currently accounts for nearly 40% of India’s crude imports, while China has increased its Russian oil imports by 22%.

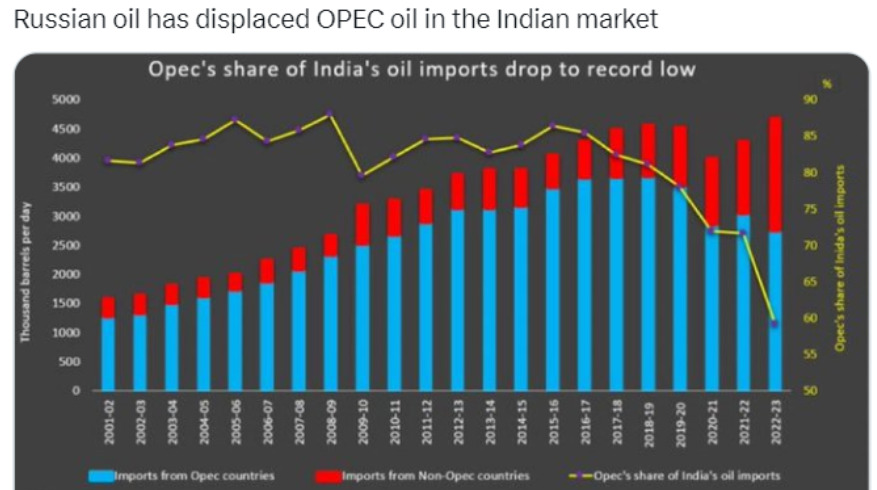

The Middle East’s oil producers have been at the receiving end of this, and saw their share of Indian oil imports drop sharply.

Sooner or later, Middle Eastern refiners may need to revise their official selling price to compete with Russia.

The increased demand for cheaper Russian Ural has pushed its prices past the $60/barrel cap imposed by the G7, and the price differential between Russian Ural and Brent had narrowed to 20% by the end of April 2023. Finance Minister Nirmala Sitharaman has said that India is going to keep buying Russian oil past the price cap, as long as it remains cheaper than Brent crude.

Can India increase Russian oil imports?

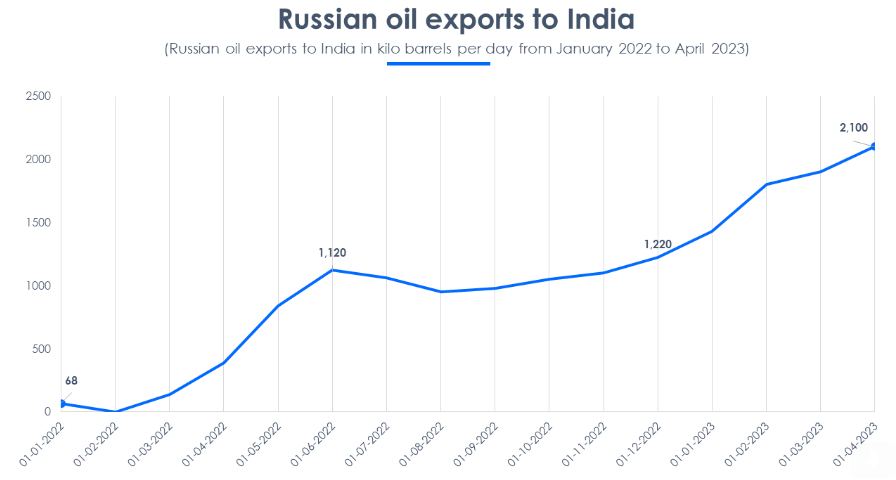

India increased its Russian imports from 67,500 barrels/day in January 2022 to 2.1 million barrels/day by the end of April 2023. Russia is now India’s single major source of oil supply. Whether India can increase its Russian oil imports further is a complex question.

“India has struggled to find an alternative currency to the US dollar for purchasing Russian crude oil. Russia’s removal from the international SWIFT payment system has made dollar transactions difficult, and exposes India to potential sanctions.

Trading in INR is impractical, as Russia is a net exporter to India; receiving rupee payments would leave Russia with an excess of rupees and no way to spend them,” highlighted an industry analyst.

For now, Russia and India are trading in UAE Dirhams, which helps to a certain extent as it is pegged to the dollar. But this does not completely solve the INR depreciation issue. UAE is a net exporter to India, so India buying more Dirhams for Russian trade will cause the INR to depreciate against the Dirham.

India also cannot stockpile much Ural oil due to its limited strategic petroleum reserve of 5.33 MMT, which covers only about 9.5 days of national demand. In contrast, countries like China have significant reserves that can meet nearly 50 days of their national demand.

A potential solution for India is to rapidly refine and export more Russian oil. But Indian oil refineries are operating at full capacity, with overall capacity utilization exceeding 100% since May 2022.

In January 2023, capacity utilization reached almost 107% , and state-run firms like Indian Oil Corporation reported even higher figures at 110%. India cannot increase oil exports without investing in additional capacity expansion projects.

Russian oil wears an Indian disguise, as India becomes the top fuel exporter to Europe

The European Union banned seaborne crude imports from Russia starting from February 2023. At the time, Russia accounted for nearly 30% of European crude imports.

While the US has increased its crude oil exports to Europe by more than 70%, it is unable to meet all of Europe’s needs. So Moscow is rerouting Russian oil to Europe via refineries in India, China, Africa and the Middle East. India has become the hub for sending Russian Ural to Europe as refined oil.

India’s oil refineries are processing and exporting Russian crude to Europe. India supplied roughly 3,65,000 barrels per day to Europe in April 2023, an increase of 187% since the start of the Russia-Ukraine war in February 2022.

However, India cannot completely substitute Russian oil exports to Europe, which averaged around 1.1 million barrels per day before the start of the conflict. India is limited here by its refining infrastructure.

The idea behind the sanctions was to cripple Russia’s revenue source without completely cutting off the global oil supply. The plan has worked, but it’s not been foolproof. Russia is still making money, just not as much. Oil supply to Europe has continued, but routed through India and China.